Farm Aid supports the Fair Credit for Farmers Act, which was developed by our partners Rural Advancement Foundation International-USA (RAFI) and the National Family Farm Coalition (NFFC) with Senator Gillibrand (D-NY). The groundbreaking bill is based on the belief that all farmers deserve fair treatment at the Farm Service Agency (FSA). This has not always been the case; but the Fair Credit for Farmers Act seeks a fundamental shift in the dynamic between farmers and FSA, to a relationship where farmers have protections and can be co-equal partners with FSA staff in seeking farm success.

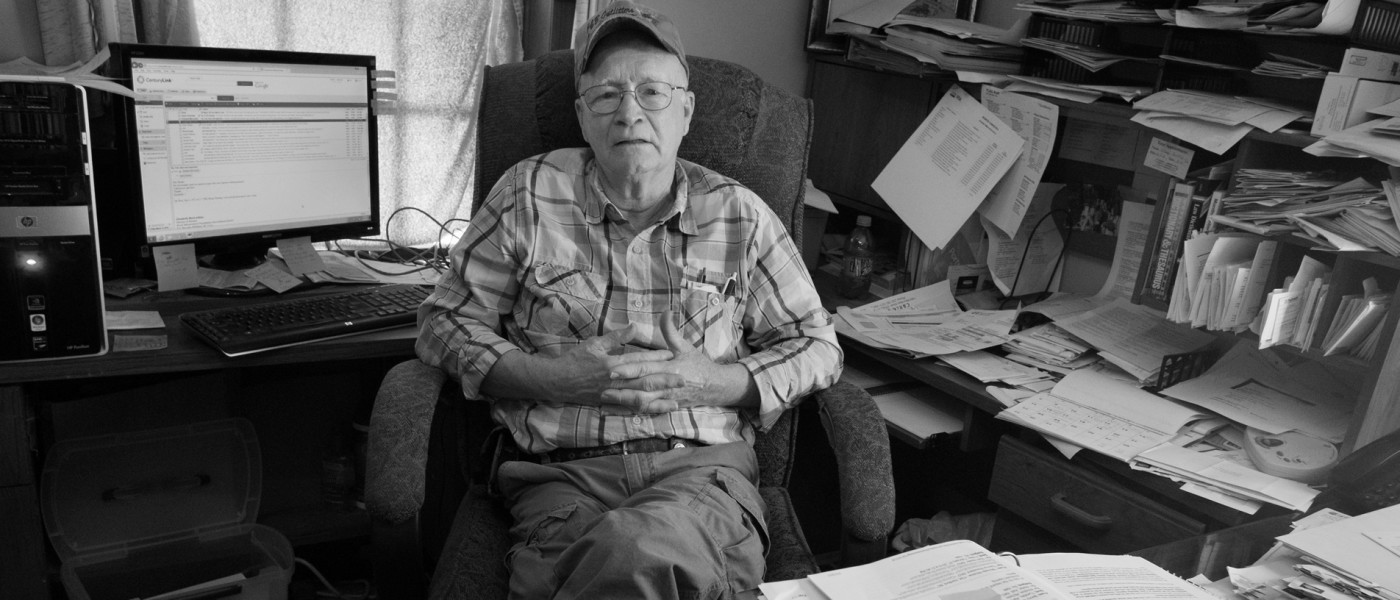

RAFI’s policy work comes from the work they do directly with farmers, and the Fair Credit for Farmers Act emerges directly from their Farm Advocacy work, whereby they assist farmers who are in financial crisis with expert, in-depth technical assistance to navigate their financial options and find a way through tough times. Farm Aid’s hotline refers many farmer callers to RAFI for this purpose. This work often involves helping farmers access FSA credit, and RAFI’s lead farm advocate Benny Bunting has helped, and often saved, hundreds of farms over decades of this work.

When Benny sits down at a farmers’ kitchen table or walks into an FSA office with them, he gets a close-up view of the ways that our current laws and regulations—and often, the ways they are implemented by agency staff—can either help or hinder farms. The Fair Credit for Farmers Act emerges from those experiences. Access to credit is an essential tool for farmers to acquire land, yearly operating funds, and the ability to grow and strengthen their businesses. The Farm Service Agency is an essential agricultural lender, the place farmers can go when other lenders deny them loans.

All farmers deserve fair treatment at the Farm Service Agency, but unfortunately this has not always happened: RAFI has seen a lot of bad treatment and injustice in the course of their financial casework with farmers. Farmers encounter obstacles and delays as they seek loans, and often have to put up their homes as collateral in order to have their loans approved.

The Fair Credit for Farmers Act (S.2668 and H.R.5296) will improve access and accountability in the FSA loan application and appeals process. Click here to learn more and take action to support this crucial bill.